Plugins

Proven Strategies That Keep You Ahead of the Market

Batter Up I

Scan, Identify and Trade

This innovative library plug in gives you a start to finish set of trading tools that will take you from scanning for potential trades, to identifying opportunities to trade execution.

Add new highlight bar patterns, criteria and used by some of the world’s most successful traders.

- Use criteria and filters to scan the markets for potential buy and sell setups.

- Identify trading opportunities based on volume, moving average, momentum and price movements.

- Review historical performance of 3 built in strategies.

Don’t get caught just randomly choosing a market without reason. Step up to the plate and look for Stock or Futures market trading opportunities that will give you the results you need.

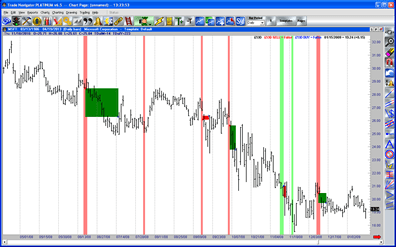

iZOD Strategy

Best when used with intraday data, this strategy will enter long positions at the current high plus one point when an iZOD buy pattern is recognized, and enters short positions at the current low minus one point when an iZOD sell is recognized. The iZOD strategy uses a 1 point risk exit rule for tight risk control.

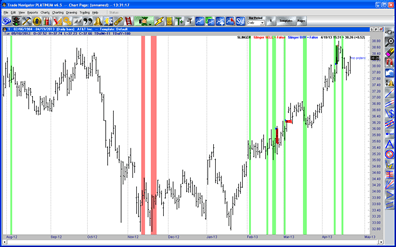

Slinger Strategy

Also best used with intraday data, the Slinger strategy enters long positions 2 points above the new high established using the Slinger buy pattern and enters a short positions 2 points below the new low established using the Slinger sell pattern. The strategy will risk only 4 points and take profits at an established dollar amount.

iSLAND Strategy

This intraday stock strategy is a pure reversal strategy that enters long positions at the current high when an iSLAND potential buy signal is recognized. The reverse is taken at the current low when an iSLAND potential sell signal is recognized. There are no exits since it is a reversal strategy (each entry rule is the other’s exit).